AI additionally enhances depreciation forecasting by dynamically adjusting schedules based mostly on real-time data, decreasing human error and guaranteeing compliance with accounting standards. This allows finance teams to optimize tax planning and make smarter capital funding choices. It includes equal depreciation bills each year all through the complete how to calculate salvage value of an asset helpful life until the entire asset is depreciated to its salvage worth. In the manufacturing sector, salvage value is integral for assessing the life expectancy and residual worth of kit and equipment. These calculations assist handle budgets, streamline replacements, and plan for future investments.

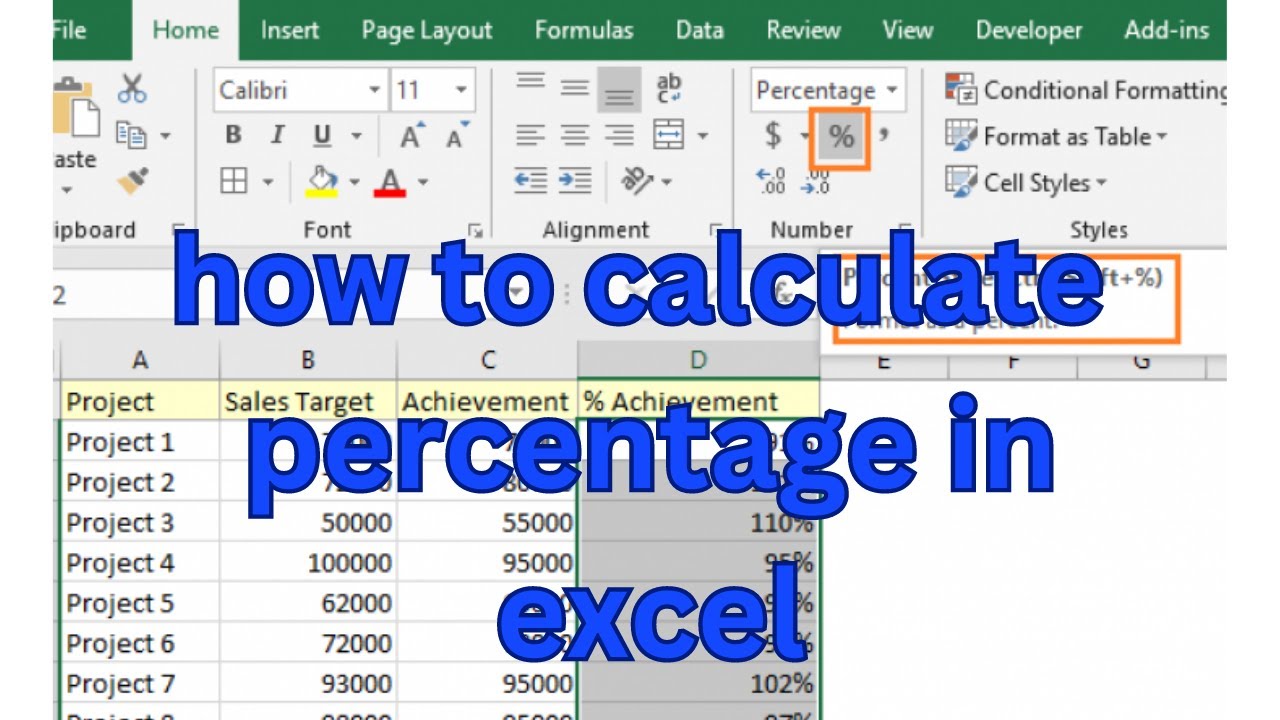

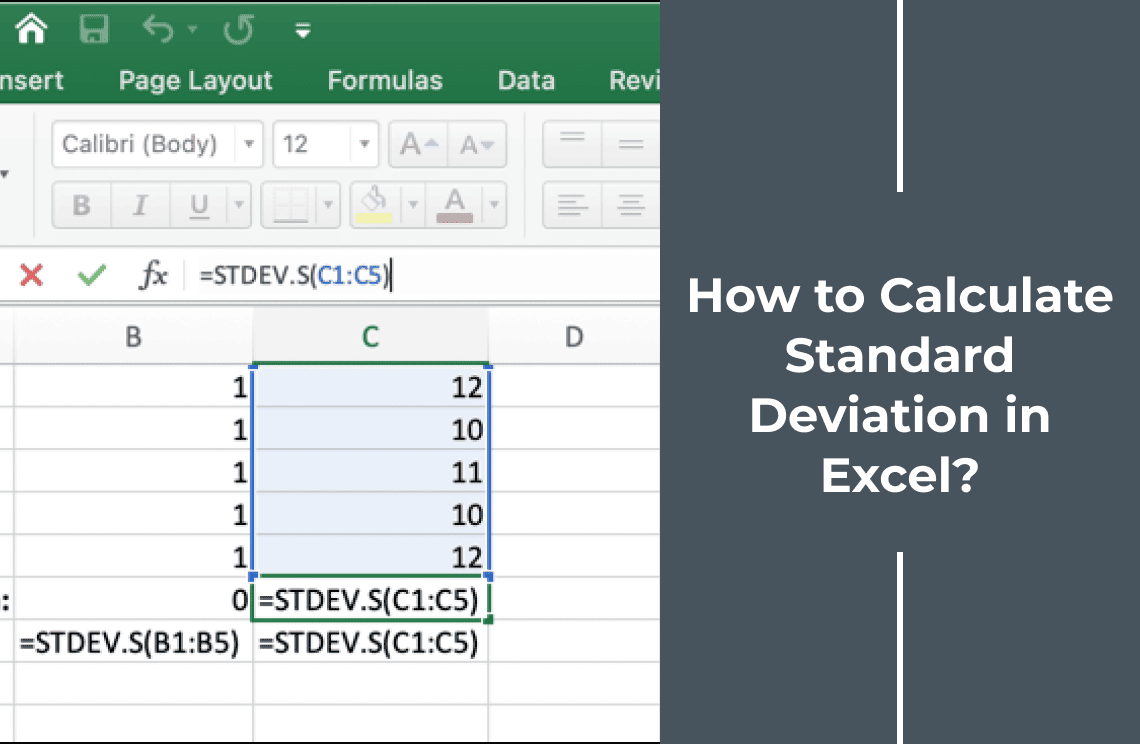

Tools usually incorporate options like real-time data analytics, customizable stories, and situation modeling. If your client’s companies have any mounted property, figuring out the salvage value of these property is necessary later when calculating depreciation. Although there is no precise formula for calculating an asset’s salvage worth, two strategies are commonly utilized in apply. For example, as a result of fast technological developments, a straight line depreciation methodology is most likely not appropriate for an asset corresponding to a computer.

The double-declining balance technique doubles the straight-line price for sooner depreciation. With a 20% straight-line price for the machine, the DDB methodology would use 40% for yearly depreciation. The unique worth or initial cost of an asset consists of its purchase price, set up costs, and some other bills incurred to deliver the asset to a usable state. For example, if an asset has a cost of $10,000 and a useful life of 5 years, the straight-line price could be $2,000 per year. Nevertheless, with the double-declining balance method, the speed is doubled to $4,000 per yr. The double-declining balance methodology is a depreciation technique used to calculate the discount in value of an asset over its useful life.

The useful life assumption estimates the variety of years an asset is anticipated to remain productive and generate revenue. Residual values are additionally called break-up values, scrap values, and salvage values. Companies can even use trade knowledge or evaluate with related present property to estimate salvage value.

In the “Asset Age (Years)” area, enter the number of years the asset has been in use since its buy. This could possibly be the current age of the asset or a future point at which you want to calculate its salvage value. If the salvage worth is greater than the book value then revenue added after deducting the tax, the value/ quantity then left is known as after-tax salvage worth. The after tax salvage worth online calculator supplies us the after-tax value of the salvage of the asset. The salvage or the scrap worth is estimated when the useful life of an asset is over and can’t be used for its unique objective.

1 Theoretical Evaluation Of Transmission Lines’ Financial Life Modeling

- Understanding the CSED helps taxpayers manage obligations and avoid prolonged collection actions.

- This article just isn’t meant to offer tax, legal, or funding advice, and BooksTime does not present any services in these areas.

- This ensures compliance with accounting standards, maintains the integrity of economic knowledge, and presents a practical view of an organization’s value.

- It is the value a company expects in return for promoting or sharing the asset at the end of its life.

Predictive forecasting allows real-time updates and adjustments to salvage worth estimates, helping corporations adapt quickly to changes in market circumstances or asset performance. This know-how permits companies to enhance decision-making, cut back risks, and optimize asset administration methods. When making funding decisions, understanding an asset’s salvage worth is essential. It can considerably affect the expected return on funding by offering a clearer image of potential future money flows.

Depreciation Strategies For Valuing Belongings Over Time

Incorrect calculations of the residual worth can result in mismatched earnings and typically unaccountability. Thus, despite the scrap value being a tough estimate, it must be done carefully. Salvage value is essential because it’s the e-book worth or an estimated worth of a particular asset after the depreciation has been utterly expensed. In different words, it influences the final depreciable amount utilized by an organisation to discover out its depreciation schedule. There’s additionally something known as residual worth, which is quite related however can mean various things.

Straight-line Depreciation Technique

It could be calculated if we will decide the depreciation rate and the useful life. For tax purposes, the depreciation is calculated in the US by assuming the scrap worth as zero. Incorporating a strong ERP system like Deskera can considerably improve how businesses manage and calculate salvage value. Deskera ERP supplies complete asset management features that streamline the monitoring, depreciation, and eventual disposal of assets. Additionally integrating an AI mechanism like ERP.AI to your ERP system can make it smarter by enhancing enterprise course of, information governance & decision-making. Taking these concerns into account ensures higher financial planning and more strategically aligned decisions concerning asset liquidation and reinvestment.

There may not be any salvage worth left after the gear or one other asset is used. It may be zero if the estimated value of its disposal or sale is equal to or close to the amount expected to be acquired for the asset. Accordingly, on this case, the amortized value earlier than the beginning of the asset usage shall be equal to its original value. It is hard to think about any sort of business with out a minimal of https://www.kelleysbookkeeping.com/ a while of long-term belongings on its books.

Age And Useful Life

It could be inaccurate to imagine a computer would incur the same depreciation expense over its whole helpful life. Imagine you are an employee of a mid-sized company tasked with evaluating the financial viability of a serious equipment upgrade. The current machinery, after years of service, is approaching the tip of its useful life. You’re confronted with the choice of whether or not to promote it or hold it until it turns into obsolete. To make an informed selection, you want to calculate the after-tax salvage worth of the equipment, which is able to considerably impression your company’s monetary statements and tax liabilities.